This article was published with our July 2020 newsletter, and forms the first part of a review of the Customer Union’s second aim, to work for an eventual return of the Co-op Bank to full co-operative ownership.

Since then the ownership has changed. You can see an updated version here.

In this first part we look into who owns the bank now.

In the second part (October 2020) we discuss our strategy for moving forward with advocating for a change of ownership.

Update: Note that in April 2021, JC Flowers and Bain Capital Credit together purchased Blue Mountain Capital's shares in the bank. See our May 2021 newsletter for more details.

The Co-op Group’s exit

To briefly recap the story so far, until 2013 the Co-operative Bank plc was 100% owned by The Co-operative Group. This is the cooperative that runs 80% of the Co-op shops. It is owned by its millions of customer members. However in 2013, the bank got itself into deep financial trouble and it became necessary to arrange a ‘bail-in’. This meant that the Group's shareholding fell to 30% and a group of private equity and hedge funds were left owning most of the rest.

This was the event that led to the formation of Save Our Bank, and later the Customer Union with the two aims: to safeguard the bank’s Ethical Policy and help bring about a return to co-operative ownership. We believe that the campaign and the union has played a significant role in achieving the first aim. The second aim is much more difficult.

In 2017 the bank went through a second restructuring where the private investors had to put in more capital. As a result of this the Co-op Group sold all its remaining shares, leaving the bank 100% owned by private equity, including hedge funds.

So - who owns the Co-op Bank now?

At first, when the Group sold its shares, it was unclear exactly which funds owned exactly how many shares. However the bank has reported the full list of its ‘B’ shareholders in the 2019 Accounts1. In fact these are shareholders in a holding company, which owns 100% of the bank.

The list is of the bank’s “B shareholdings”, those with more than a 10% share. B shareholders have voting rights. There are also other 'A' shareholders without a vote - we believe that many are individuals and that they may own as much as 30% of the bank.

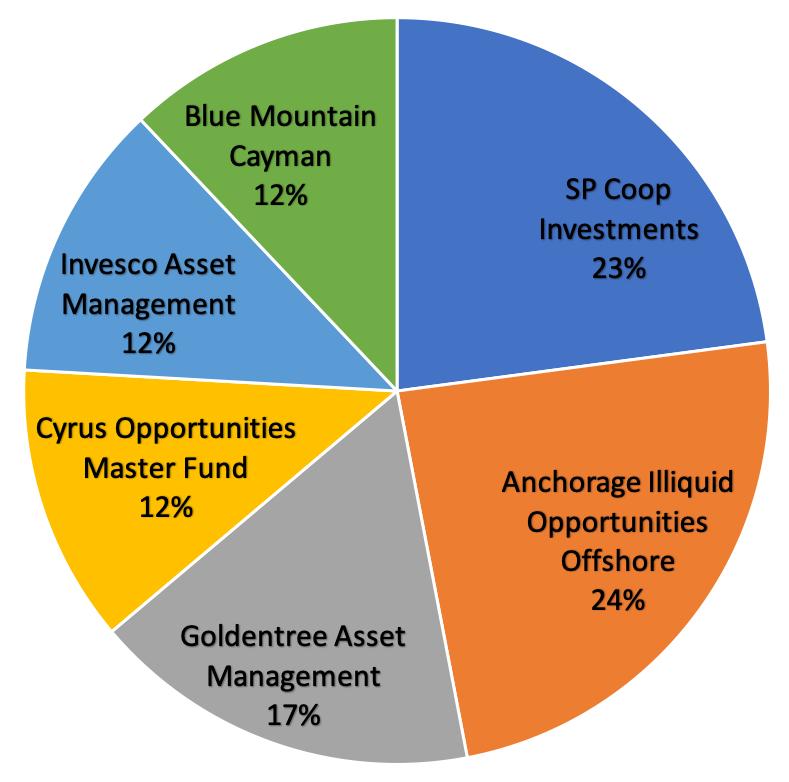

'B' shareholdings in the bank

As at 26th February 2020, the bank’s B shareholders in order of size were:

- SP Coop Investments, Ltd (22.89%). This is understood to be a fund set up by Silver Point Capital [$13.6bn AUM] to manage its holdings in the bank. Silver Point is a US-based hedge fund, which the Guardian described in 2013 as “known for fighting hard when their investments run into trouble”. They have been one of the major investors in the Co-op Bank since 2013.

- Anchorage Illiquid Opportunities Offshore Master V.L.P (24.10%). Part of Anchorage Capital Group, a large US hedge fund with a focus on “operational turnarounds and special situations investments”, according to its website. Anchorage first invested in the bank in 2017.

- Goldentree Asset Management Lux S.A.R.L. (16.87%). A Luxemburg-based subsidiary of the US investment firm of the same name. Goldentree manages money on behalf of pension funds, foundations, sovereign wealth funds and other large asset owners. It has also only been mentioned as an investor in the Co-op Bank since 2017;

- Cyrus Opportunities Master Fund II, Ltd (12.05%), Part of Cyrus Capital Partners, a smaller US hedge fund which emerged as an investor in the bank in 2017;

- Invesco Asset Management Limited (12.05%), the UK arm of a large mainstream US investment management company with branches in 20 countries and holdings in companies globally. Invesco is one of the original 2013 investors in the bank;

- Blue Mountain Cayman SP (12.05%), likely to be a Cayman-Islands-based fund of BlueMountain Capital Management LLC, another US hedge fund with troubles of its own, also on the radar as an investor in the Co-op Bank since 2017. [Note: in April 2021, JC Flowers and Bain Capital Credit together purchased Blue Mountain Capital's shares in the bank. See our May 2021 newsletter for more details.]

There are other firms that were listed as investing in the bank in 2013, which have apparently sold up their stakes and moved on – Perry Capital Management, Beach Point Capital Management, Caspian Capital, Canyon Capital Advisors and Monarch Alternative Capital and York Capital Management are some of the names that were reported. We don’t know if these companies made any money on their investment.

A word on hedge funds

A hedge fund is a kind of investment fund which is typically only open to very wealthy investors. The term “hedge fund” comes from the idea of “hedging risk” (or “hedging your bets”); i.e. protecting yourself against risk by investing in areas that tend to compensate each other. But arguably this has become a misnomer: hedge funds are no longer focused on reducing risk – they tend to pursue high-risk investment strategies to maximize profits.

Hedge funds don’t have a great reputation – they often use tax havens (like Luxemburg and the Cayman Islands, mentioned above), and are lightly regulated with limited transparency. Several of the above listed funds have also been linked to major donors to the US Republican Party in reports by Ethical Consumer magazine.

Not all of the bank’s investors are hedge funds – Invesco and Goldentree are mainstream asset managers, which tend to work for a wider range of clients including pension funds and governments rather than just a select group of millionaires. However, we don’t have any favourites among these investors - none of them are co-operatives, and a return to co-operative ownership is what we seek.

What’s likely to happen next with the Co-op Bank’s ownership?

We don’t expect the Co-op Bank’s owners to stick around for ever, although some of them have been invested for seven years – longer than we might have expected in 2013. The latest news on plans for the bank’s ownership came in December last year, when it was reported that the Co-op Bank’s owners had hired Goldman Sachs to advise on a potential sale of the bank. Sky News said that “Barclays, Lloyds Banking Group and Royal Bank of Scotland are said to have been among those approached about a deal.”

A sale of the Co-op Bank to a large mainstream bank is likely to be a threat to the integrity of the bank’s Ethical Policy. If the bank’s balance sheet were to be absorbed into that of the new owner, its ethical stance on avoiding ‘unethical’ business (as determined by customers’ concerns) would be lost. However, the bank’s owners, and most likely any future buyers, know this would damage the bank’s uniqueness and lead to an exodus of some of its customers – damaging the bank’s value.

As a Union of customers concerned about the bank’s ethics and ownership, we’re determined to do whatever we can to avoid any sale that would undermine the bank’s ethics, and to encourage the current owners to ensure a return to at least partial co-operative ownership. We’re under no illusions about how difficult this might be.

In the next part of this review we’ll discuss in more detail what might happen next, and our plans for what we see as the most likely scenarios.

In any case, as a co-operative ourselves, we’ll make sure to consult with our members on what happens next.

1. The Co-operative Bank pointed out to us that we got our A and B shareholders mixed up in the original version of this article. All shareholders have 'A' shares. Those with more than 10% have 'B' shares. Thank you to the bank for this.