Welcome to this newsletter from the Customer Union for Ethical Banking, the independent union for customers of The Co-operative Bank.

In this month’s newsletter, our report from the Gathering last month, plus a few other choice nuggets of Co-op Bank news.

Report from our Gathering

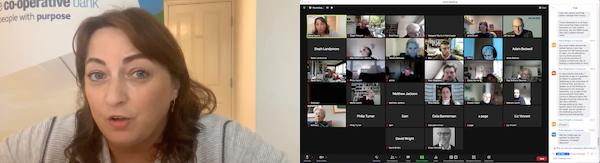

Our 6th annual Gathering took place on Saturday 20th November online, with over 30 Customer Union members and supporters in attendance. We were pleased to welcome Co-operative Bank executive board member Maria Cearns and Co-ops UK Chief Executive Rose Marley to present and join the discussions.

First up, Maria Cearns gave a brief overview of the bank’s activities in 2021, its return to profit, its assessment by Sustainalytics and its continuing work with charitable organisations Refuge, Centrepoint and Amnesty international. However she gave the majority of her time to answering the many and various questions from CUEB members and supporters - the now-traditional members’ grilling of the bank.

Questions ranged from product and service-related issues to the strategic plans of the bank going forward. The news of the bank’s recent interest in acquiring TSB was also covered, as were the bank’s intentions for its own carbon emissions reporting and target-setting. Maria also discussed the outcomes of the Ethical Poll, thanking CUEB members who took part and speaking of how happy she was to see outcomes that reflect the global ethical values held by the bank’s customers. There were also assurances that the bank was not looking to remove anything from the current Ethical Policy, but to make it stronger.

The second half of the Gathering was devoted to a discussion of an “ownership vehicle”, through which CUEB members and others could build a co-operatively owned stake in the bank. After years in which this seemed like an unacceptably risky prospect, this is starting to feel like an idea whose time has come. CUEB secretary Rob Harrison introduced our plan to investigate the options for building such a vehicle and set these out in a report in the coming months. Rose Marley, Chief Executive of Co-operatives UK since January this year, spoke of Co-operatives UK’s support for this plan, and members and supporters raised their own questions and considerations, which will feed into our scoping of this report.

In addition, Rose presented on Co-operatives UK’s work and its relationship with the Co-operative Bank, under which the bank needs to demonstrate its commitment to co-operative values through an annual attestation to Co-operatives UK.

Thanks to all who joined the Gathering; as always it was an inspiring discussion! We have a longer version of this Gathering report on our website here.

Other Co-op Bank news nuggets

To round off this month’s newsletter, some recent news that caught our eye, both from and about the Co-op Bank:

- Firstly, the Co-op Bank’s latest Ethics in Action newsletter has been sent out to customers, and is well worth a read, including news and links to get involved in the bank’s human rights and climate campaigning. (The link was provided by our board member, Carol, which is why you will see “Hello Carol” at the start!)

- Various sources including ShareCast and The Register report that the bank is ending its mortgage outsourcing contract with Capita - years ahead of schedule - transferring people working in areas like customer service and application handling across to work directly for the bank. This strikes us as good news.

- Also striking us as broadly positive is news that the bank has invested half a million in Manchester-based financial technology (“fintech”) company Bankifi. The Co-op will be able to roll out apps and online platforms developed by Bankifi before others. We hope this means the bank will be upping its game on customer-friendly banking platforms in the months and years to come.

That’s all for this month, and for 2021. Coming out of the Gathering, our 2022 is already shaping up to be a busy and exciting one – with two big tasks for the top of the agenda: moving towards a concrete plan for an ownership vehicle, alongside the current Ethical Policy review.

Thank you for subscribing, and for your great support for our work. See you in the new year!

With best wishes,

The Save Our Bank team