Welcome to this June newsletter from the Customer Union for Ethical Banking, the independent union for customers of The Co-operative Bank.

We hope you’re enjoying the warmer weather and the loosened Coronavirus restrictions after the tough months of lockdown.

This month, Co-operatives Fortnight, a look at the new shardolders in the bank, and the bank’s Ethics in Action newsletters.

Co-operatives Fortnight

From 21st June to 4th July it’s Co-operatives Fortnight, two weeks of events celebrating the power of co-ops. The Co-op Bank is sponsoring the Co-operative of the Year Awards as well as Co-op Congress, the co-op movement’s flagship event of the year. Sponsorship from the bank has allowed the organisers to ensure the event, on Fri 25th June, is free to attend this year. Tickets to attend, online or in person at Stretford Public Hall, can be booked here.

The first week of Co-ops Fortnight is focused on encouraging more people to #JoinACoop. As well as being focused on advocating for ethics and co-operative ownership at the Co-op Bank, at the Customer Union for Ethical Banking we’re proud to be established as a co-operative ourselves. We’re owned by our members, over 1300 of you, and everything we do is powered by your annual membership fees. So, if you’re not yet a member, why not mark Co-operative Fortnight by joining the union?

The first week of Co-ops Fortnight is focused on encouraging more people to #JoinACoop. As well as being focused on advocating for ethics and co-operative ownership at the Co-op Bank, at the Customer Union for Ethical Banking we’re proud to be established as a co-operative ourselves. We’re owned by our members, over 1300 of you, and everything we do is powered by your annual membership fees. So, if you’re not yet a member, why not mark Co-operative Fortnight by joining the union?

And if you are a member, thank you for your amazing support! Why not send a message on Twitter to let people know and encourage them to join a co-op as well.

Suggested tweet:

I'm proud to be a member of @SaveOurBank, the co-operative Customer Union for @CooperativeBank customers.

I'm proud to be a member of @SaveOurBank, the co-operative Customer Union for @CooperativeBank customers.

Millions of people are members of #coops. Are you? #JoinACoop during #CoopFortnight

Ethics in Action newsletters since January

Since late last year the Co-operative Bank has been sending “Ethics in Action” newsletters every six weeks to customers who have signed up to receive marketing emails. If you’re not getting them in your inbox, you can update your preferences on the banking app. You can read the most recent editions of Ethics in Action at these links: January, March, April and June.

Since late last year the Co-operative Bank has been sending “Ethics in Action” newsletters every six weeks to customers who have signed up to receive marketing emails. If you’re not getting them in your inbox, you can update your preferences on the banking app. You can read the most recent editions of Ethics in Action at these links: January, March, April and June.

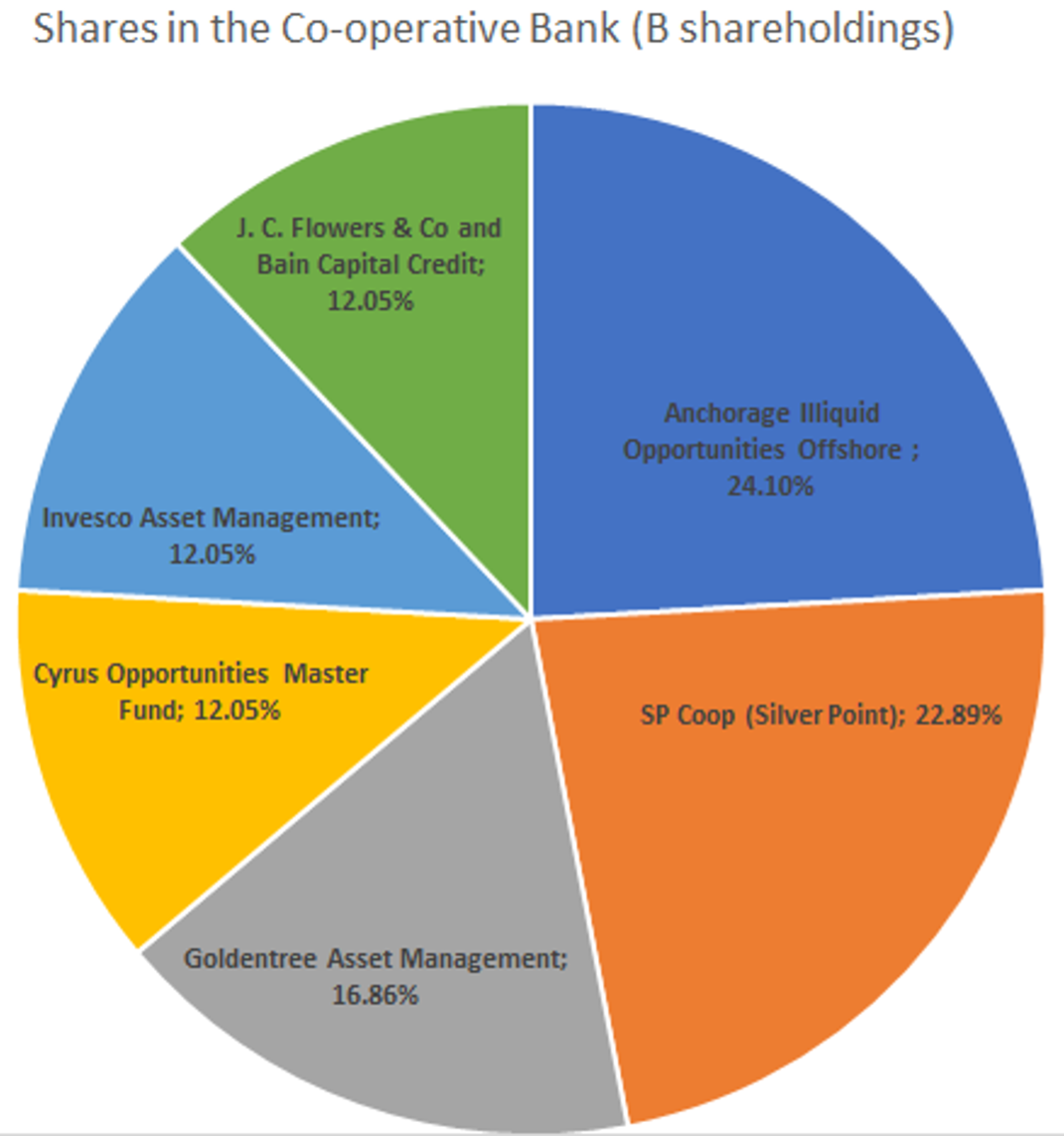

Who are the Co-op Bank’s newest shareholders?

Last month we brought you news that one of the bank’s shareholders, US hedge fund Blue Mountain Capital, has sold its 10.01% stake in the Co-op Bank to two private equity funds, J.C. Flowers & Co. and Bain Capital Credit. This month, a bit more detail on these new shareholders and what the deal might mean for the bank.

Both J.C. Flowers and Bain are large investors that specialise in buy-outs. Of the two, Bain has the more colourful history. As a result of having two-time US presidential candidate Mitt Romney as one of its founders, it’s attracted a fair amount of scrutiny over the years, including in-depth story in Rolling Stone magazine published during Romney’s second campaign in 2012, on the topic of “how the GOP presidential candidate and his private equity firm staged an epic wealth grab, destroyed jobs – and stuck others with the bill.” (Interestingly, despite the Romney link, during the 2020 election cycle Bain donated millions to the Democrats.)

Both J.C. Flowers and Bain are large investors that specialise in buy-outs. Of the two, Bain has the more colourful history. As a result of having two-time US presidential candidate Mitt Romney as one of its founders, it’s attracted a fair amount of scrutiny over the years, including in-depth story in Rolling Stone magazine published during Romney’s second campaign in 2012, on the topic of “how the GOP presidential candidate and his private equity firm staged an epic wealth grab, destroyed jobs – and stuck others with the bill.” (Interestingly, despite the Romney link, during the 2020 election cycle Bain donated millions to the Democrats.)

More recently, Bain Capital has moved to take over and demutualise the mutual life insurer Liverpool Victoria, or LV=. The take-over has been criticised by MPs, although it is LV= rather than Bain which has been on the receiving end of most of the criticism, for failing to adequately consult its members.

J.C. Flowers, unlike Bain, is focused on buying financial services companies. (Its holdings can be seen on its website.) Like Bain, though, its recent moves in the UK financial sector have included demutualising a building society: in 2010 it rescued and demutualised Kent Reliance, leading to the creation of OneSavings Bank. The BBC noted at the time of the transaction that the deal “would give Flowers the needed licence to operate and expand in the UK.”

The record of both funds in demutualising UK building societies is not, of course, reassuring, but it is also unlikely to have much bearing on their strategy for the Co-op Bank. Instead, the media rumours have been that the two funds will push the bank to start buying rival “mid-tier” banks, with Sainsbury’s Bank and TSB being mentioned by both Sky and the Daily Mail’s This is Money. (Of course one media outlet could have just copied the other.)

With the bank only just having moved into profit for one quarter of the year, this kind of speculation is probably best taken with an unhealthy amount of salt for now. It’s also worth remembering that J.C. Flowers and Bain Capital Credit together own just 10% of the bank, so this change in ownership is unlikely to lead to a massive shift in strategy overnight.

For anyone wanting to remind themselves who owns the other 90% of the bank, we’ve updated our ”Who owns the Co-op Bank” web page to reflect the changes.

With best wishes,

The Save Our Bank team

Have you joined the Customer Union yet? It costs £12 a year to be a member of the first ever customer union co-operative, and help us ensure the Co-op Bank sticks to its principles. It only takes a few moments to sign up here.