Welcome to this first newsletter of the new year from the Customer Union for Ethical Banking, the independent union for customers of The Co-operative Bank. Although it is already February, we first want to take this opportunity to wish you a happy new year - we hope it is off to a good start.

In this month’s newsletter: how we’re powering up for the next five years; why we’re raising the price of Customer Union membership from £12 to £15 a year, and what the next few months have in store.

Powering up for the next five years

Since the Customer Union was formally registered in 2016, we’ve achieved a lot with a little. With a base of around 1,200 paying members and 10,000 supporters, and a team of four people who all have other day jobs, we have secured a recognition agreement with the Co-operative Bank, held quarterly meetings with them to represent your views and concerns, held annual gatherings, and scrutinised the bank’s ethical reporting each year.

In that time, we’ve seen the bank return to meaningful campaigning on issues like climate change and human rights, as well as commit to return to having Ethical Policy reporting externally audited, and we’ve arguably established a level of customer influence that goes beyond that in place when the bank was co-operatively owned. With all this, we think we are successfully meeting our first aim, of ensuring the Co-op Bank maintains its strong customer-led ethical stance.

In that time, we’ve seen the bank return to meaningful campaigning on issues like climate change and human rights, as well as commit to return to having Ethical Policy reporting externally audited, and we’ve arguably established a level of customer influence that goes beyond that in place when the bank was co-operatively owned. With all this, we think we are successfully meeting our first aim, of ensuring the Co-op Bank maintains its strong customer-led ethical stance.

On our second aim, to work for an eventual return of the Co-op Bank to co-operative ownership, we have further to go - but we have a plan. We think the time is now right to move forward with setting up a vehicle that can acquire a cooperatively-owned stake in the bank. In 2022 we’ll set out this plan in more detail and seek the funding we need to put it into action.

Why we’re raising the price of membership

Membership of the Customer Union has cost £12 a year, or just £1 a month, ever since it was first established in 2016. In that time, our membership has grown but not enough yet to cover our costs, and we have been reporting a small loss most years. At £15 a year (£1.25 a month), we’ll be able to cover our costs at our current membership level, and have a stable basis on which to grow. That’s why we've spoken to members at our Gathering in November, and asked our board in December, to approve this rise in the price.

We know that the cost of everything is going up at the moment, and although we think this increase won’t be an issue for most people, we know it may be for some. We’re happy to give a waiver to members who are in financial hardship. Please contact us if that’s the case for you.

If, like most of our supporters, you’re not yet a member, please do consider joining and help us continue our work and reach our ambitions on ownership. (Maybe it’s not too late for an extra new year’s resolution?)

If, like most of our supporters, you’re not yet a member, please do consider joining and help us continue our work and reach our ambitions on ownership. (Maybe it’s not too late for an extra new year’s resolution?)

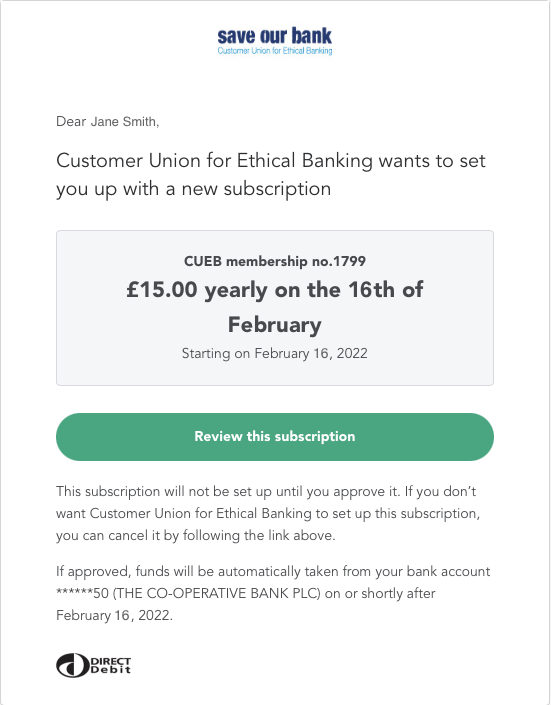

The price rise will apply to renewals from 16th February. Due to the way our payments system works, if you’re a member paying by direct debit you might be sent an email from GoCardless (see image) asking you to approve the subscription at the new price. Please do follow the instructions in that email (click on the green button), otherwise the price change won't take effect.

What’s coming up for the Co-op Bank and the Customer Union?

In February we’re expecting the bank to release its new Values and Ethics Report covering 2021 - and the bank has assured us it really will be externally audited this time. We will, as ever, scrutinise this report and give you a summary of the most interesting developments, as well as raising questions for the bank where we think we need to.

Then in April we’re expecting the long-awaited launch of the bank’s new Ethical Policy - its first update since 2015. The bank has talked to us already about the results of its ethical survey, and also given us the chance to comment on the existing policy, so we’ve been busy in January providing input on what could be improved upon and what new commitments we would like to see. We’re eager to see the results.

Beyond this, our main focus for the year will be moving forward on our ambitions for ownership. Stay tuned.

Thanks for your support!

With best wishes,

The Save Our Bank team